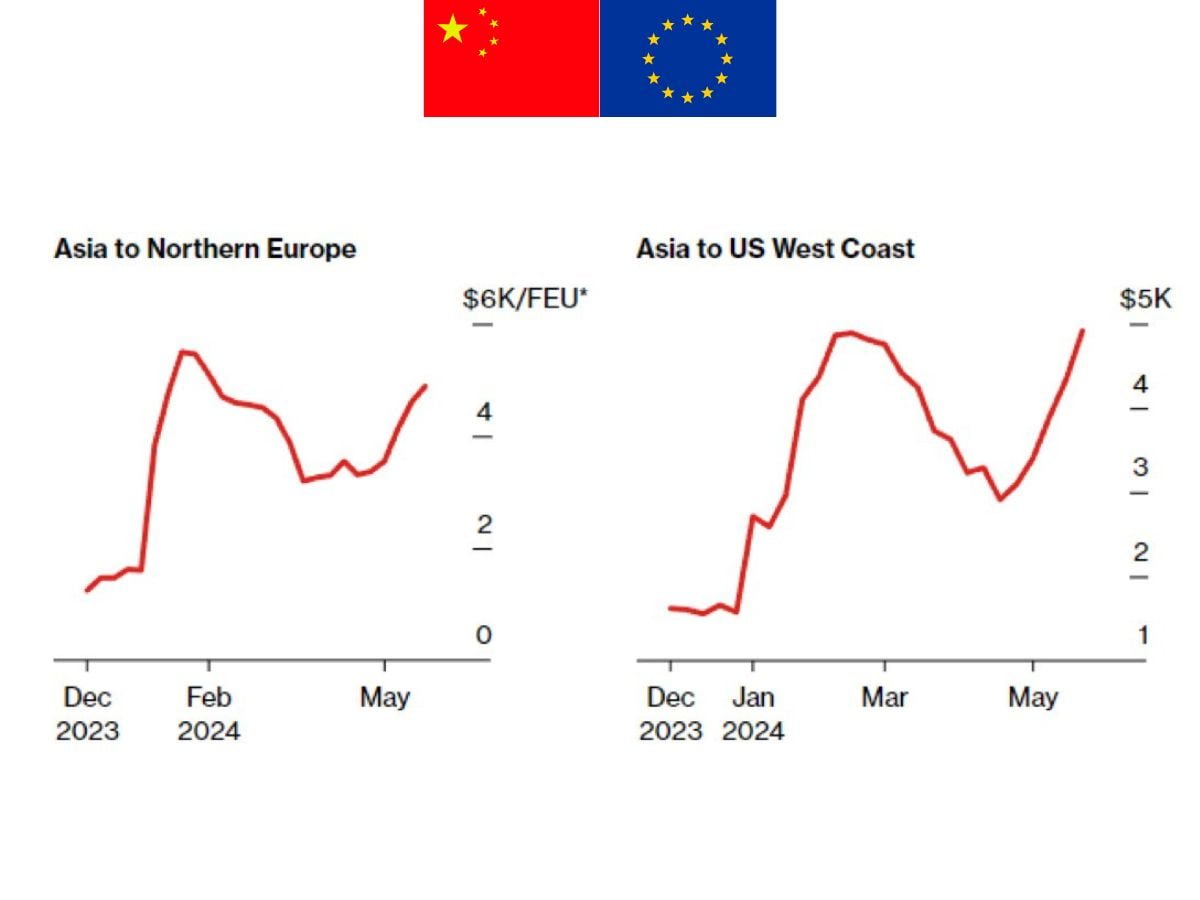

We are now at the end of May 2024 and sea, rail and air freight prices are rising again. The situation where the cost of transporting a container rises from US$1,000 to US$5,000 is happening again. In this article we take a closer look at this phenomenon.

Crisis in the Red Sea caused by Huti attacks

The attacks on the Red Sea continue and freighters are forced to sail around Africa, increasing the time and cost of shipping to Europe. The crisis is also causing a problem with the return of containers, which, after arriving in Europe, must eventually make their way back to China. The problems on the Suez Canal only exacerbate the problem - a shortage of containers.

We can see that the rates for a 40-foot container in May are averaging approx. USD 5,000, which is almost 5 x times increase from January 2024. Below is a chart showing the rates in 2024.

Electric car exports from China to Brazil and Mexico

According to reports, Brazil and Mexico are planning additional tariffs on Chinese cars in July 2024. For this reason, many electric car manufacturers are shipping their products en masse to South America in fear of the change. According to market reports, Chinese company BYD has already delivered 100,000 vehicles to the South American market. Maritime shipowners are taking advantage of the demand in this market and freighters are partly being seconded to operate between China and South America in order to take advantage of the market opportunity.

Several players dictating terms

There are only a few larger sea-going shipowners in the market, who are undoubtedly taking advantage of the current situation of turmoil to raise rates. The freight prices of many shipowners are relatively similar and one can see a tendency for the major companies to equalise their rates. Such a situation also historically occurred during COVID-19 where rates were as high as USD 15 000 per 40 HC container from China to Europe.

Maritime market directly influences rate increases in rail and air markets

Rising sea freight rates and red sea disruptions causing delays mean that more volumes in the supply chain are shifting to rail and sea transport. The law of supply and demand is at work here - with increasing demand and the same supply, prices will rise. The number of containers transported from China to Poland in January 2024 was 14 532 in 20-foot container equivalent. This is 36 % higher than the corresponding period in January 2023. These figures show the scale of the increase in demand for rail transport from China.