When importing goods from China, VAT and customs duties must be paid. In order to legally introduce goods from China for sale in the European Union, the trader is required to carry out customs clearance.

At customs clearance VAT and customs duty will be charged. Once these two duties have been paid, the goods will be able to be released and further marketed.

VAT on imports from China

Import VAT is calculated from the customs value of the goods, customs duty and sometimes excise duty if applicable. As for VAT rates, they can be 5 % , 8 % or 23 %. For most goods imported from China, the VAT rate is 23 % and this is the most common rate. It is quite rare to find the other rates, and it is worth noting that they apply to specific product groups.

After customs clearance, we receive an SAD and a PZC customs document. When importing, it is always advisable to use the help of a customs agency, which will properly direct the settlement of our import. When the goods arrive in Poland, it is best to contact the customs agency, which will require from us an invoice for transport containing the terms of delivery, an invoice for the goods, packing lists and, if necessary for some products, a CE certificate, declaration of conformity or other necessary documents. Customs agency declares goods for clearance Once all the documents have been completed and in the next step, we receive a post-clearance communication and the calculated amounts of VAT and customs duty that we have to pay. It is often the case that the customs duty, i.e. VAT and customs duty, is paid directly to the customs agency, which settles the duties and pays them to the customs office. At a later stage, when accounting for the import of goods, the invoice for the purchase of the goods and precisely the customs document SAD, which we received after customs clearance, must be forwarded to the accounting department that handles the company.

10% discounts for the first transport

On offer: Rail, air and sea transport

Customs duty on imports from China:

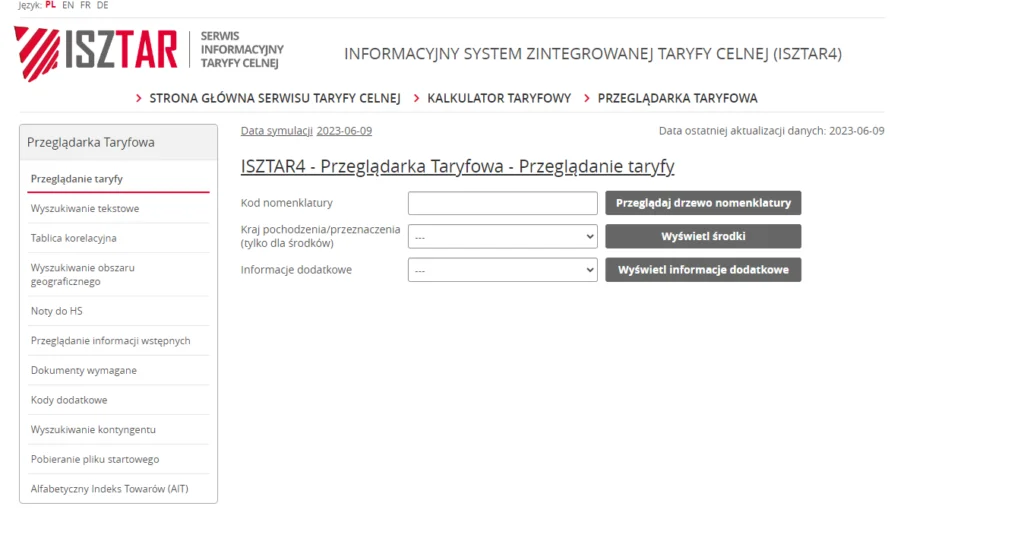

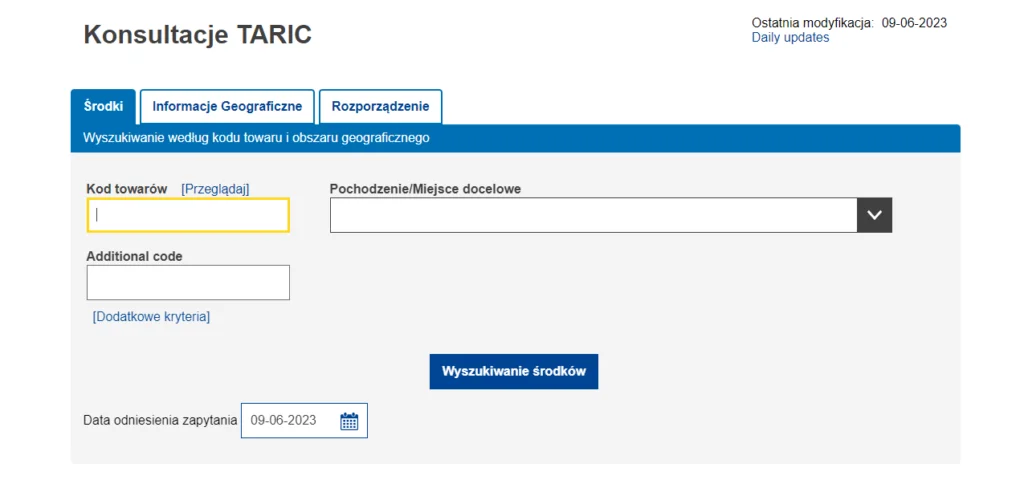

As far as the duty on imports from China is concerned, it depends on the type of product we are importing. According to the Customs Union, the duty is unified throughout the entire territory subject to the European Union. Duty rates are usually a few percent, but there are cases where there is an anti-dumping duty and it can be as high as 50 %. Before importing, it is very important to check exactly what duty you will pay. It may happen that there is an indication from the system that the goods are exempt from paying duty. This can be done using the ISZTAR or TARIC tariffs, where you will find the exact rates that are indicated in the customs system. I have pasted the link to both tariffs below:

Instructions on how to accurately check tariffs will soon be available on our blog.

For example, the duty on watches from China is 4.5 %.

Customs Agencies:

Customs agencies clear goods on behalf of the importer and will often help match the tariff rate for the goods. Often HS codes are provided by Chinese sellers which helps to determine the tariff rate, but it is always worth verifying the accuracy of this tariff with the customs agency, due to the fact that the Chinese can often tariff goods incorrectly in order to make the duty payable as low as possible. However, this may be challenged by customs. In this case, it is a good idea for the tariffs to be verified by the trader. The rules of the Middle Kingdom are significantly different and the customs and tax system operates on different principles there.

The VAT or duty rate will be expressed in the local currency, in this case PLN. The office converts the invoice currency in USD at the average exchange rate of the day.

When importing goods from third countries, we will always have to expect to pay VAT and customs duties.

If we have doubts about the tariff classification of a particular product because it fits into several categories, we can present the tariff classification in question to the chief inspector and request an individual written opinion, in which the goods are clearly classified under a specific HS CODE. In this way, we can refer to this decision when importing the product in question during subsequent customs clearances.

Ordering samples:

In the case of ordering a sample pack If its value does not exceed EUR 150, we are exempt from customs duties.

How to transport goods from China?